What Is This Metric?

Unpaid invoices / billing failures measure the amount of money that has been billed, but has not yet been received.

This metric is critical to all types of businesses. For example, if you didn’t account for unpaid invoices to commercial customers in your bakery business plan, you could easily run out of money.

While this metric is important to all businesses, it’s critically important to Software as a Service (SAAS) businesses who automatically bill their customers periodically (e.g., monthly).

Why Should I Care?

When customer payments are not received, clearly it’s not a good thing. And, in particular for SAAS businesses, it lowers your Lifetime Customer Value, which reduces how much you can spend to acquire new customers and thus limits your growth.

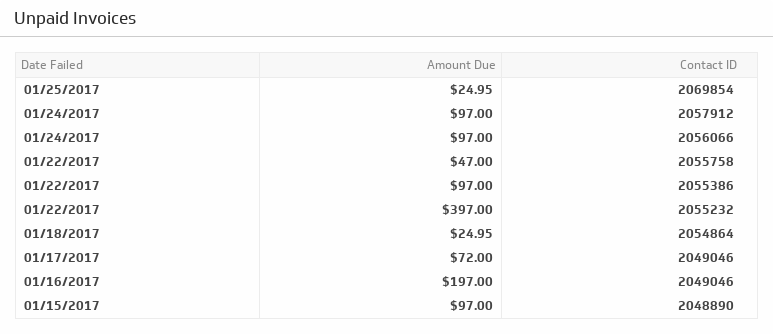

Also by looking at a list of billing failures, you can directly contact the people whose billing has failed in order to get the money you are owed. This is crucial because even if your sales are consistent, you should still be making sure you’re actually receiving the payment from purchasers.

What Does It Look Like?

How Do I Improve this Metric?

Particularly if you are billing your customers via credit card, there are several tactics you can use such as 1) making sure you periodically request that customers update their credit card information, 2) automatically trying to re-charge credit cards in the days after they first fail, and 3) enrolling in a credit card update service that automatically changes your customer credit card data over time.

Whether you’re billing customers via credit card or not, having effective customer/invoice follow-up procedures in place will also help.